Loan Calculator

Car's Loan Calculator

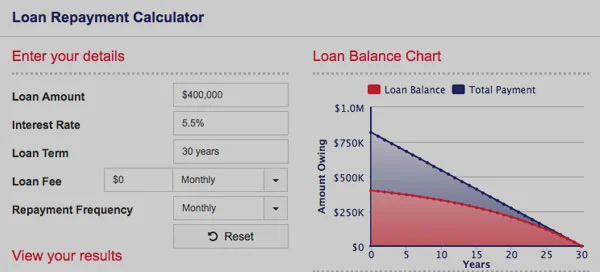

Our Free loan calculator finds the repayment plan, interest cost, and amortization schedule of conventional amortized loans, deferred payment loans,

A loan calculator can assist in calculating a loan's interest rate

A loan calculator may assist you in determining the cost of a loan depending on a variety of variables. The rate of interest is one of these elements. The quoted yearly rate of interest is the interest rate (r). When obtaining an installment loan, this rate is the most crucial factor to consider. This rate will help you calculate the monthly payments you can afford based on your income and other variables. In addition, you may determine the origination charge and payment frequency.

Rate of interest

If you are seeking a loan calculator, you have arrived at the correct spot. Loan calculators provide the estimation of monthly payments for any sort of fixed loan. You only need to enter the loan amount, the duration, the interest rate, and the first payment date. Once the information has been input, the calculator will compute the monthly payment and total interest paid throughout the life of the loan. A loan calculator may be used for a range of purposes, from calculating the cost of credit cards to calculating the sum of a home mortgage.

A loan calculator may help you determine how much you can afford to borrow and whether it will fit into your monthly budget. It will consider your loan amount, interest rate, and the number of months required to repay the loan. It will also generate an amortization plan that breaks down your payments into principal and interest. Additionally, you may input an expected APR to obtain a better understanding of the monthly payment amount.

Loan term

The duration of your payment period will be displayed by a loan calculator. The interest rate on a loan relies on a variety of factors, including the amount borrowed, the length of the loan period, and your credit history. A longer payment period typically results in a higher interest rate, since the lender accepts a greater risk by granting you additional time to repay the loan. In addition, the longer the time of repayment, the greater the likelihood of a missed payment or default.

A loan calculator is a helpful tool for calculating the monthly installments for any fixed loan type. To use a loan calculator, you must input the amount of money you wish to borrow, the loan's length, the interest rate, and the date on which you wish to begin making payments. The findings will indicate how much you owe and when you should pay it off. Before entering the information into a loan calculator, there are a few considerations to bear in mind.

Cost of origin

An origination fee is a percentage of the total loan amount that is removed from the amount borrowed before distribution. You may input the loan amount you like to borrow into a loan calculator, and the tool will compute the total cost of the loan, including fees. You must also specify the semesters for which you intend to apply for a loan. If you are uncertain about your eligibility for a loan, you may use this calculator to determine it.

In addition to origination costs, you may encounter other expenses. Others add them independently. These expenses might consist of processing fees, application fees, and underwriting fees. In any case, you should be aware of what each of these fees covers and how much you may anticipate spending. If you do not know what each origination charge covers, they should be factored into your loan calculator. Below is a list of typical mortgage fees.

Payment Frequency

Adjusting your payment frequency might save you a significant amount of money on interest charges. The payment frequency feature of a loan calculator is a useful tool for calculating the monthly payment and the amount of principal owed. It can also compute the interest you'll pay for the loan's duration. The loan payment calculator comprises a dozen inputs and settings, which we will describe in further detail below. Additionally, it may be modified to accommodate for unusual durations, such as leap years and three-month intervals.

The ability to determine the amount of your monthly payment or any other frequency is one of the most useful aspects of a loan calculator. It may also be used to estimate your monthly mortgage or auto payment. This calculator gives an introduction to the loan payment formula and an explanation of how payments are computed. It is also capable of calculating varying interest rates dependent on payment frequency. The basic calculator assumes monthly payments and monthly compounding of interest.

Loan amount

A loan calculator is a handy tool for determining the amount and frequency of a borrower's repayments. This sum includes both interest and the principal balance. In addition, it may display the monthly or yearly payment amount. Before applying for a loan, you should verify the interest rates and terms, as the payback frequency varies for different borrowers. In some circumstances, you may opt to make additional payments in addition to the monthly or annual payment.

Another significant feature of the calculator is its ability to compute the total loan payment based on monthly payments. This can assist borrowers to assess if they can repay the total loan amount within a certain time frame. For instance, if you borrowed $1,000 over a year, you would be responsible for paying back 9% of the loan amount. Using a loan calculator, you may decide if lending the money is worth the expense.

Using this calculator, you can calculate all types of loans including auto loans, home loans, and boat loans.

Please also check our other tools like GST Calculator, Margin calculator, Discount Calculator, and sales tax calculator

English

English

Bahasa Indonesia

Bahasa Indonesia

Português

Português